Course Profile

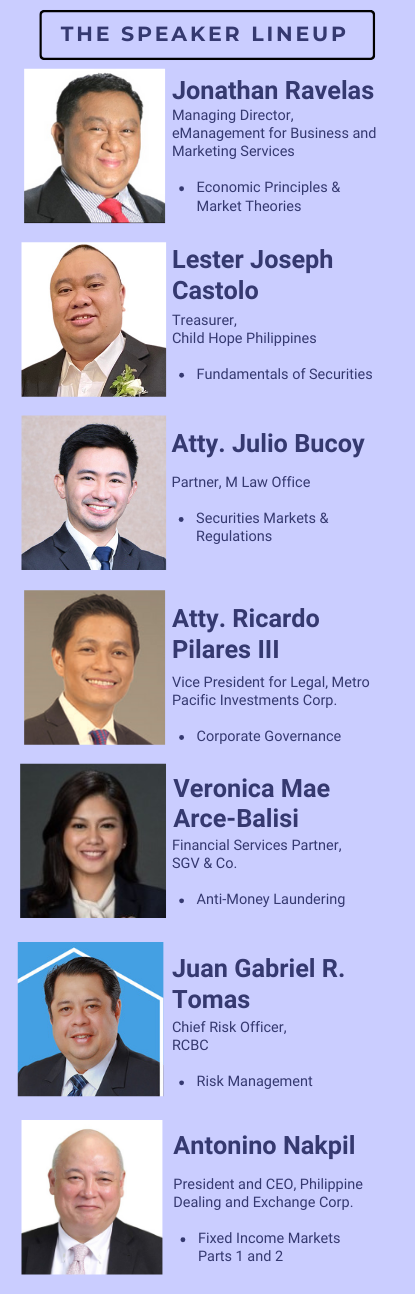

We have UPDATED AND IMPROVED this two-part course to provide you with enhanced knowledge, practical skills, and market intelligence to stay on top of market developments and gain a competitive edge in understanding the operation and intricacies of the capital markets. The course is spread over eight sessions with one topic and speaker for each session that should allow for a comprehensive presentation of the session topic, and active engagement between the participants and lecturers. Our experts who will conduct the courses sessions are known personalities in their respective fields and come from major corporations and banks that will lend their theoretical and practical knowledge in their respective subject matters.

The sessions are curated and anchored on the subjects covered by Modules 1-6 (Phase 1), and Module 7 (Phase 2) of the SEC licensing exams for fixed income salesmen and associated persons.

Course 1 (six sessions/modules) will provide the essential tools that securities salesmen, analysts and associated persons need to perform their functions effectively, as well as other individuals who want to have a better understanding of the workings of the Philippine Capital Markets for their professional development. The topics covered in these sessions or modules will include; (a) economic fundamental principles and capital market theories, (b) the features of various types of securities, (c) the different securities markets, their structures, participants, and regulations governing these participants, (d) corporate governance principles, € anti money laundering and counter terrorism financing regulations and insights on detection and reporting, and (f) principles of risk management and its applications in the capital markets.

Course 2 (two sessions/modules), on the other hand, will do a deep dive into the fixed income market and delve into the roles of the various market participants, bond valuation and bond issuance, listing and trading processes. This course will discuss at greater length and detail the risks inherent in fixed income investments. It will also cover credit analysis, with focus on understanding key financial ratios.

The courses will be conducted virtually and capped with self-assessment examinations. Required advance readings will be provided to participants prior to the conduct of the sessions.