Dear Finance Profession,

We are excited to share with you an official invitation of attendance, to one of the leading Africa Public Finance Management Leaders Conference' in Dubai, U.A.E this year.

We have made it possible for you to get an official invitation letter and documentation towards participation at the Africa Public Finance Management Leaders Conference' in Dubai, U.A.E.

Fill in your details below and you will automatically get your Invitation letter, use the description that would fit your address and title on the invite letter. You can request several times based on how you fill appropriate, e.g. an invite to, Finance director, CEO, CFO or Supervisor etc.

Theme: Towards Sustainable Development: Innovations in Public Finance for Africa's Future

Conference background

The Africa Public Finance Management Leaders' Conference aims to bring together key leaders and stakeholders in public finance management across the African continent. This conference provides a platform for participants to engage in discussions, share insights, and collaborate on addressing the challenges and opportunities related to public finance in Africa. By fostering knowledge exchange and promoting best practices, the conference seeks to contribute to the effective and transparent management of public finances, ultimately driving economic development and sustainable growth in the region.

The public finance management sector at the present

Public finance management has witnessed significant transformations in recent years steered by technological advancements, regulatory changes, globalization and evolving market dynamics. Below are some of the key transformations:

Technology Integration: With the increasing role of technology in various aspects of governance, public finance management is likely to see further integration of digital tools and platforms. This could include the adoption of advanced financial management systems, blockchain for transparent transactions, and data analytics for improved decision-making. The use of artificial intelligence (AI) in financial forecasting and risk management is also increasingly becoming a trend.

Optimizing big data analytics in decision making: There's a shift towards data-driven decision-making, leveraging big data analytics to gain insights into financial performance, identify trends, and forecast future outcomes. This transformation enables more informed and strategic decision-making in areas such as budget allocation, investment strategies, and resource optimization.

Sustainable Finance: The global focus on sustainability and environmental responsibility is expected to impact public finance. Governments are likely to prioritize investments in green projects, renewable energy, and initiatives that promote environmental sustainability. Sustainable finance practices, such as green bonds and social impact bonds, may become more prevalent as countries aim to align their financial strategies with environmental and social goals.

Public-Private Partnerships (PPPs): The collaboration between the public and private sectors through PPPs is anticipated to continue as a trend in public finance. Governments may increasingly leverage private sector expertise and resources for the development of infrastructure projects, allowing for more efficient and cost-effective implementation. Proper risk-sharing mechanisms and transparent governance structures will be crucial for the success of PPPs.

Resilience Planning: The global community has witnessed various economic shocks and crises in recent years, and this trend is likely to continue. Public finance management strategies may evolve to include enhanced resilience planning, with a focus on building financial buffers, contingency funds, and risk management frameworks. Governments may prioritize creating financial systems that are better equipped to withstand economic uncertainties and external shocks.

Risk management: There's a heightened focus on risk management, particularly in the wake of global economic uncertainties and financial crises. Both public and private sector organizations are enhancing their risk management frameworks to identify, assess, and mitigate various types of risks including market risk, credit risk, operational risk, and regulatory risk.

Digital Currencies and Cashless Economies: The rise of digital currencies and cashless transactions could impact public finance management. Governments may explore the use of central bank digital currencies (CBDCs) and other digital payment systems to streamline financial transactions, reduce costs, and enhance transparency. The adoption of digital currencies may also influence tax collection methods and prompt governments to update their regulatory frameworks.

Who should attend

- Chief executive officers

- Chief financial officers

- Chief accounting officers

- Chief risk officers

- Public finance managers

- Risk & compliance managers

- Finance directors

- Financial analysts

- Revenue/expenditure officers

- Auditors

- Accountants/financial assistants

- Budget directors/controllers

- Cash flow managers

- Expenditure/revenue officers

- Credit managers

- Any other person interested in public finance management

Benefits to delegates

- Acquire practical skills on policy implementation strategies.

- Gain policy insights on governmental policies, fiscal regulations, and economic trends.

- Gain a deeper understanding of the challenges and opportunities in public finance management

- Acquire valuable benchmarks and ideas for improvement in financial management practices.

- Stay updated in the rapidly evolving landscape of public finance.

- Building valuable partnerships/collaborations with other professionals in the industry.

Conference topics

- Exploring the evolving policy and regulatory landscape governing ESG considerations in public finance management.

- ESG disclosures and reporting as a form of risk management strategies.

- Ethical and responsible investment practices: stakeholder engagement to mitigate reputational, legal and financial risks.

- Rethinking risk management strategies: Integrating sustainability criteria into infrastructure planning and investment decisions.

- Climate change adaptation and resilience planning as part of financial management strategies.

- Innovative structuring of PPP agreements to align with evolving societal needs and technological advancements.

- Leveraging data analytics and technology-driven solutions to identify, monitor, and manage ESG risks effectively in public finance management.

- Emerging ESG trends and their potential impact on risk management.

- AI driven policy analysis and simulation: future trends and opportunities.

Agenda

8

30AM

-

9

00AM

REGISTRATION/NETWORKING, OFFICIAL OPENING REMARKS BY HOST.

REGISTRATION/NETWORKING

OFFICIAL OPENING REMARKS

10

00AM

-

10

30AM

Coffee/tea Break

30 minutes break

10

30AM

-

11

30AM

11

30AM

-

11

45AM

Coffee/tea break

15 minutes break

12

45PM

-

1

00PM

Group photo session

Group photo session

Tuesday, June 18, 2024

8

30AM

-

9

00AM

10

00AM

-

10

30AM

Coffee/tea break

30 minutes break

10

30AM

-

11

30AM

11

30AM

-

11

45AM

Coffee/tea break

15 minutes break

12

45PM

-

1

00PM

End of day remarks

Key takeaways

End of day remarks

Wednesday, June 19, 2024

8

30AM

-

9

00AM

10

00AM

-

10

30AM

11

30AM

-

11

45AM

Coffee/tea break

15 minutes break

11

45AM

-

12

45PM

12

45PM

-

1

00PM

Award of certificates ceremony

Award of certificates ceremony

Vote of thanks

Official closing remarks

Thursday, June 20, 2024

9

00AM

-

10

00AM

Half Day Full Excursion Tour

Excursion

10

00AM

-

10

30AM

10

30AM

-

11

00AM

11

30AM

-

12

00PM

12

00PM

-

12

30PM

12

30PM

-

1

00PM

1

00PM

-

2

00PM

Friday, June 21, 2024

8

30AM

-

10

30AM

Open Free Day

Open Arrangement:

Opportunity to network with corporations and have business meetings with potential partners from USA public finance sector.

INVITATION LETTER

OFFICIAL INVITATION LETTER

Fill in your details below and you will automatically get your Invitation letter, use the description that would fit your address and title on the invitation letter. You can request several times based on how you fill appropriate, e.g. an invite to the Finance / HR Department, or CEO or Supervisor, etc.

Click Here to Start your automated Official Invite Application

DOWNLOAD FULL CONFERENCE BROCHURE

Here is you Full conference Agenda Download for Internal Application!

Use the button below to Download!

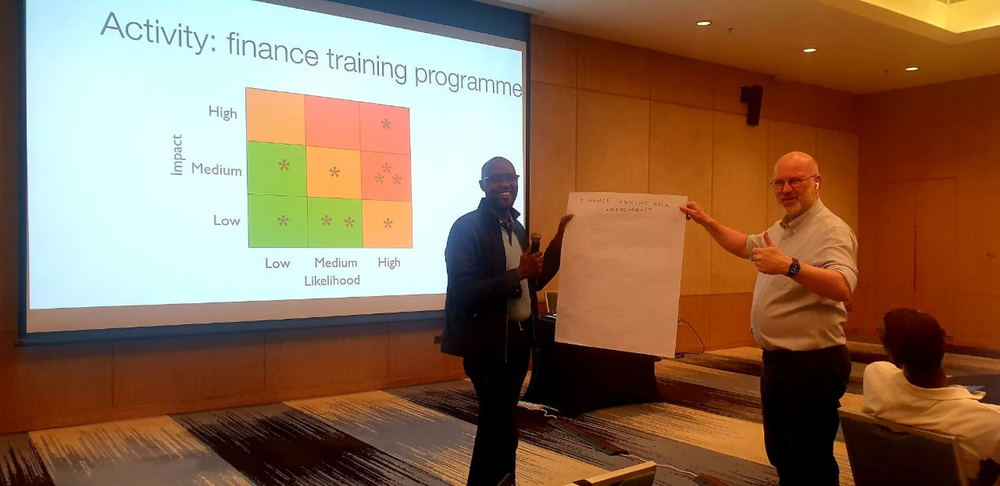

PAST EDITION GALLERY

Tickets

BLOCK Booking - (3 DELEGATES BOOKING)

$6,270

Buy TicketTax Settings: zero VAT for International Delegation

1 ticket = 3 Attendees @ $2,090 per Delegate