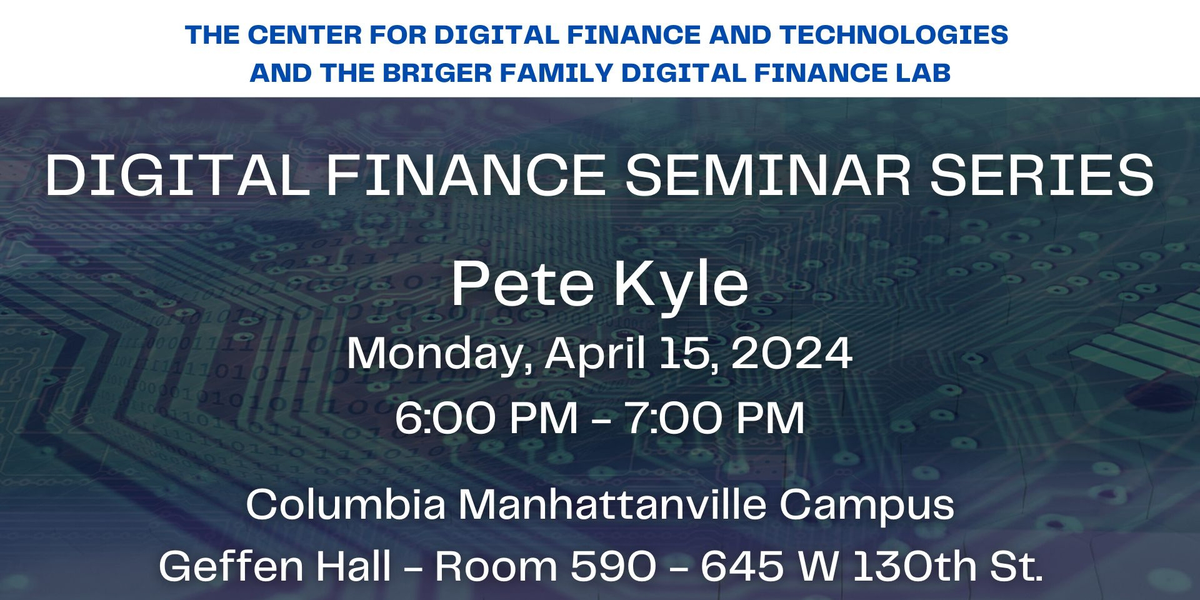

Event Details

Title:

Flow Trading

Abstract:

We introduce and analyze a new market design for trading financial assets. The design allows traders to directly trade any user-defined linear combination of assets. Orders for such portfolios are expressed as downward-sloping piecewise-linear demand curves with quantities as flows (shares/second). Batch auctions clear all asset markets jointly in discrete time. Market-clearing prices and quantities are shown to exist, despite the wide variety of preferences that can be expressed. Calculating prices and quantities is shown to be computationally feasible. Microfoundations are provided to show that traders can implement optimal strategies using portfolio orders. We discuss several potential advantages of the new market design, arising from the combination of discrete time and continuous prices and quantities (the most widely used alternative has these reversed) and the novel approach to trading portfolios of assets.

Bio:

Albert S. (Pete) Kyle has been the Charles E. Smith Chair Professor of Finance at the University of Maryland's Robert H. Smith School of Business since 2006. He earned his B.S. degree in mathematics from Davidson College (summa cum laude, 1974), studied philosophy and economics at Oxford University as a Rhodes Scholar from Texas (Merton College, 1974-1976, and Nuffiled College, 1976-1977), and completed his Ph.D. in economics at the University of Chicago in 1981. He has been a professor at Princeton University (1981-1987), the University of California Berkeley (1987-1992), and Duke University (1992-2006).

Kyle's research focuses on market microstructure, including topics such as high frequency trading, informed speculative trading, market manipulation, price volatility, the informational content of market prices, market liquidity, and contagion.

His teaching interests include market microstructure, institutional asset management, venture capital and private equity, corporate finance, option pricing, and asset pricing.

He is a Fellow of the American Finance Association in (2013) and a Fellow of the Econometric Society (2002). He has been a board member of the American Finance Association (2004-2006). He holds an honorary doctoral degree from the Stockholm School of Economics (2013). He was a staff member of the Presidential Task Force on Market Mechanisms (Brady Commission, 1987), a consultant to the SEC (Office of Inspector General), CFTC, and U.S. Department of Justice, a member of NASDAQ's economic advisory board (2004-2007), a member of the FINRA economic advisory board (2010-2014), and a member of the CFTC's Technology Advisory Committee (2010-2012).

About the series:

The Center for Digital Finance and Technologies, together with the Columbia Business School's Briger Family Digital Finance Lab, hosts the Columbia Digital Finance Seminar Series throughout the academic year (Fall and Spring Semesters). The seminars feature a broad variety of academics, professionals, and policy markers on topics related to digital assets, including but not limited to crypto tokens and securities, decentralized finance (DeFi), blockchain consensus protocols, regulation of digital platforms, and blockchain market design. The seminars are designed to expose students, faculty, and the broader community to the latest developments in the area of crypto and blockchain economics.

For more details about the seminar series, please contact the organizers Prof. Agostino Capponi and Prof. Ciamac Moallemi.

Geffen Hall 590, Columbia Business School

645 W 130th ST

Show on map