This is a past event. Registration is closed. View other South Sudan - Uganda events.

1. THE EAST AFRICAN CRUDE OIL PIPELINE (EACOP)

Overview

- 1,445km long and 24inch diameter electric heated crude oil pipeline system from Hoima, Uganda to the Port of Tanga in Tanzania

- 296kms through 10 districts in Uganda, and 1,147kms across 8 regions and 20 districts in Tanzania

- US$ 3.565 Billion capital expenditure

- Implemented through EACOP Co., an incorporated JV between TotalEnergies, CNOOC, UNOC and TPDC

- Projected CAPEX of US$3.9 billion and OPEX > US$ 100 million per year

Project Progress

- EACOP route: approved

- FEED and ESIA (Uganda & Tanzania): completed and approved by respective regulatory bodies

- Inter-Government Agreement for the Crude Export Pipeline: signed in May 2017

- The EACOP RAP: completed and approved with implementation ongoing

- Host Government Agreements(Uganda & Tanzania): signed in April 2021

- Shareholder Agreement and Tariff and Transportation Agreement: signed in April 2021

- Procurement of Engineering, Procurement and Construction (EPC): contracting ongoing and at award stage

- EACOP Bill (Development of enabling legislation for EACOP): ongoing

Opportunities

- Direct Employment

- Construction (> 5,000 jobs)

- Engineering, Procurement & Construction Services & Works:

- Fabrication

- Construction

- Transportation

- Pipe Coating

- Accommodation

- Other related works

- Engineering, Procurement & Construction Supplies:

- Food

- Construction Materials

- Pipes

- Valves

- Cables and Transfers

- Heat exchangers

2. THE UGANDA REFINERY

Overview

- 60,000 bopd oil refinery in Kabaale, Buseruka Sub-county, Hoima District

- 210 km multi-products pipeline to Namwambula, Mpigi

- Storage Terminal in Mpigi

- Mbegu Water Intake and Pipeline

- UNOC shareholding - 40% through Uganda Refinery Holding Company Limited

- AGRC selected as Lead Investor

- Expect the East African States to invest in Refinery

- Projected CAPEX of US$ 3.2 billion, with some investment from the East African states

Project Progress

- Land for refinery development: secured

- Refinery Project Framework Agreement (between AGRC, MEMD and UNOC): signed in April 2018

- Refinery Configuration (as the Residual Fluid Catalytic Cracker): approved in February 2019

- Front-End Engineering Design (FEED) : 97% complete

- RAP Study & ValuationReports (for the 210km pipeline from Hoima to Mpigi): approved

- Refinery ESIA : 60% complete

- Mbegu Land Acquisition Process: ongoing

Opportunities

- Direct Employment

- Construction (> 5,000 jobs)

- Engineering, Procurement & Construction Services & Works:

- Fabrication

- Construction

- Transportation

- Pipe Coating

- Accommodation

- Utilities

- Engineering, Procurement & Construction Supplies:

- Food

- Construction Materials

- Pipes

- Tanks

- Valves

- Cables

- Heat exchangers

- Petroleum Services:

- Fuel Quality Testing

- Industrial Inspections

- Corrosion Services

- Hazardous Waste Management

- Environmental Management Services

3. TANZANIA LOCAL CONTENT

Vision

- Promote economic development and national industrialization

- Implementing an industrial development plan

- Capitalize on the development phase to build the capacity of the local companies and Tanzania Citizen

- Drive the growth of the Tanzania Oil & Gas Industry in line with the objective of Tanzania for long term industrial development

Local Content Pillars

- Employment and Training

- EACOP and its main contractors will give priority to Tanzanian nationals

- All contractors must promote employment and exceed minimum employment requirements

- Contractors and subcontractors are required to provide training to improve the level of competence of the workforce.

- Goods and Services

- Priority is given to available local goods and services on an open tendering

- 10% of technical bid evaluation in Local Content

- Transparency & advertising is key in the procurement process

- The local community must be involved in the supply chain

- Reserved contracts for Tanzanian citizens

- Reserved Contracts

The following goods and services shall be provided by Tanzanian companies

- Transportation

- Security

- Foods and beverages

- Hotel accommodation and Catering

- Office Supplies

- Fuel Supply

- Land Surveying

- Lifting Equipment

- Locally available construction materials

- Civil Works

- Communications services

- Waste Management

- Capacity Building and Technology Transfer

- Partnership between international companies and local companies

- Industry Enhancement Centre, quarterly forums

- Train The Trainer

- Training for local communities

- Scholarship, Internship

- Support to local institutions

- Donations to local communities

- Business development

Engineering, Procurement, Construction & Management Goods & Services

- Procurement (Goods)

- PPE

- Foods and Beverages

- Office Supply

- Pre-engineered

- Building and Office

- Office and Camp

- Appliance and Furniture

- Signage, barriers and fencing

- Transport & Logistics

- Vehicles

- Drivers

- Travel

- Clearing and forwarding Services

- Office Space

- Security

- Hotel accommodation & catering

- Human Resource Management

- Land Surveying

- Communications & Information technology services

- Waste Management

- Legal Services

- Insurance Service

- Training Services

Tanzania EACOP Local Content Presentation

4. THE KABAALE INDUSTRIAL PARK

Overview

- The KIP is a petro-based industrial park to be developed on 29.57 Km2 of land, in Kabaale, Buseruka Sub-county, Hoima District.

- UNOC to hold 51% shareholding

- KIP will accommodate several facilities and amenities:

- Refinery

- Crude Oil Export Hub

- International Airport

- Petrochemical & Fertilizer Industry

- Light & Medium Industries

- Warehousing & Logistics

- Agro-processing

- 3year construction period with US$ 200 Million total capital expenditure

- Projected CAPEX US$19 million

Project Progress

- Master Plan: developed and approved by the Physical Planning Board - Ministry of Lands, Housing and Urban Development

- EOI for the Strategic Partner: completed and due diligence on shortlisted bidders conducted

- Land Allocation Guidelines: under final legal review

- EOI for Access & Arterial Roads, Electricity, Security, Water & Wastewater & ESIA: evaluation complete

- KIP Infrastructure Design Proposal: in development

Opportunities

- Industrial development:

- Fertilizer

- Polypropylene

- Plastics

- Industrial Gases

- Bulk LPG uptake

- Services:

- Fabrication

- Accommodation

- Construction

- Transportation

- Waste Management

- PipeWorks

- Airport Synergies:

- Agro-based industries

- Labour Mobility

- Equipment Mobility

5. UPSTREAM FIELD DEVELOPMENT

Overview

- 9 Production Licenses for Tilenga & Kingfisher Projects

- UNOC holds 15% Participating Interest as Non-operator

- Projected CAPEX of US$7.6 Billion with OPEX > US$100Million/year

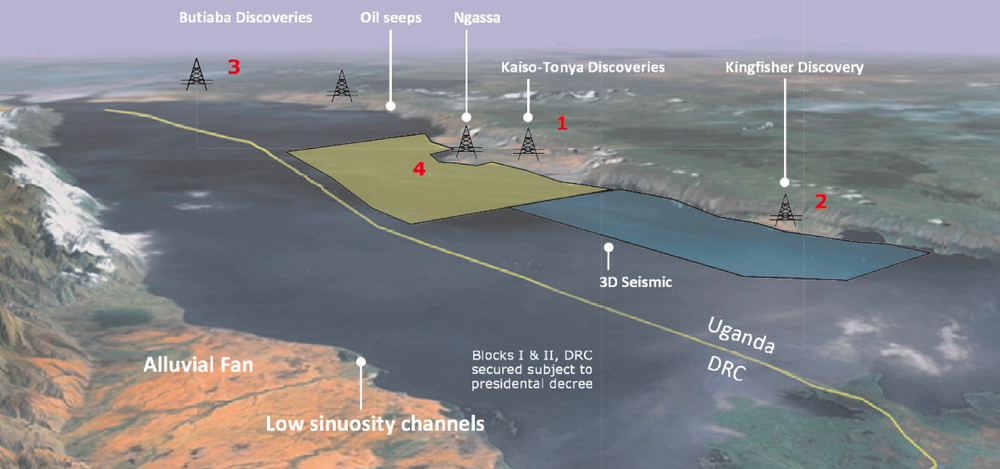

- Tilenga Project

- Operated by Total E&P

- 9 planned fields: Jobi-Rii, Ngiri, Gunya, Kasamene, Wahrindi, Kigogole, Nsoga, Ngege, and Ngara

- Central Processing Facility on northeastern shores of Lake Albert

- 190,000 bopd at peak production of 4 years

- Kingfisher Project

- Operated by CNOOC

- Pre-Project Field Activities, Development Drilling and Central Processing Facility

- Development of the Kingfisher, Mputa, Nzizi and Waraga fields

- 40,000 bopd at peak production at CPF

Project Progress

- Transfer of Interest from Tullow Uganda to Total E&P: completed in November 2020

- UNOC's back-in Deed of Assignment & Novation: signed

- Front End Engineering Design: complete & approved

- Environmental Social Impact Assessment (ESIA): completed & certificate awarded by NEMA

- RAP Studies: approved by Chief Government Valuer

- Technical Studies (to inform development and production works): ongoing

- Securing Engineering, Procurement and Construction (EPC) contractors: ongoing

Opportunities

- Engineering, Procurement & Construction

- Oil & Gas Separation Plants

- Storage Facilities

- Water Abstraction & Treatment

- Utility Systems

- Waste Management

- Fire Fighting Systems

- Drilling & Wells

- OCTG

- Well Heads

- Rigs

- Fishing

- Logging

- Solids Control

- Logistics

- Completions

- Enabling Infrastructure

- Site Preparation and construction

- Common Services

- Logistics Services

- Transportation

- Clearing & Forwarding

- ICT Operations Bases

- Infield transport & services

- Gas to power

- Compressors

- Turbines