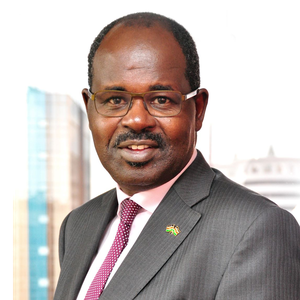

Dr. Patrick Njoroge

Governor at Central Bank of KenyaDr. Patrick Njoroge was reappointed Governor of the Central Bank with effect from June 18, 2019. He holds a Ph.D. in Economics from Yale University, the USA, and master’s and bachelor’s degrees in Economics from the University of Nairobi, Kenya. Prior to joining the Central Bank, Dr. Njoroge had a long career, spanning 20 years, at the International Monetary Fund (IMF), in Washington, D.C., USA. At the IMF, he was an advisor to the IMF Deputy Managing Director from December 2012. He also served as Deputy Division Chief in the IMF’s Finance Department and IMF Mission Chief for the Commonwealth of Dominica, as well as other capacities beginning in 1995. Prior to joining the IMF, Dr Njoroge worked in Kenya as an economist at the Ministry of Finance and as a planning officer at the Ministry of Planning. His professional and research interests are in Macroeconomics, Economic Policy, International Finance, Development Economics, Econometrics, and Monetary Policy.

Charles Ringera

Chair,CIS Kenya and CEO of Higher Education Loans Board (HELB)Charles is a seasoned banker with over 23 years’ practical banking experience that cuts across all facets of central and commercial banking. He formerly worked as a regulator with the Central Bank of Kenya (CBK) in various capacities, as a bank examiner, Kisumu Branch, Finance, Audit and National Debt. While he was with CBK, Charles was seconded to Deposit Protection Fund Board (DPFB), now Kenya Deposit Insurance Corporation (KDIC) and did statutory and recovery management in a couple of ailing financial institutions namely - Trust Bank, Kenya Finance Bank, Pan African Bank Group, Euro Bank and Delphis (now Oriental) Commercial Bank. Charles moved to Co-operative Bank in 2004 initially as Senior Credit Risk Analyst before being deployed to Enterprise-wide Risk Management as a senior manager to lay foundation for Risk Management for the bank as per the Central Bank’s Risk Management Guidelines and Basel II Accord.

In 2006, he moved to KCB Group where he headed the Group Operational Risk and Compliance supporting – Kenya, Tanzania, Southern Sudan, Uganda, Rwanda and Burundi. He assumed HELB leadership in March 2013 with a focus to converting the organization to a Human Capital Development Financial Institution (DFI) by restructuring the Institution’s capital base and enhancing alternative resource mobilization to increase the number of students funded through expansion product portfolio by enhancing the balance sheet size leaving nobody behind in access to Education.

Charles holds Bachelor of Science in Applied Accounting from Oxford Brookes University and an MBA in Strategic Management from Moi University. He is a professional accountant holding a CPA (K) and a Fellow of Association of Certified Chartered Accountants, FCCA. He also holds an Advanced Diploma in Risk Management in Banking/Finance by KPMG Sweden. He sits in the following Boards;

• President of AAHEFA – Association of Africa Higher Education Financing Agencies,

• Chairman of Credit Information Sharing Kenya (CIS Kenya)

• Council Member of KCA University and Chair of Audit Risk and Compliance Committee

• Board Member Kenya Universities and Colleges Central Placement Services Board (KUCCPS) and Chair of the Technical Committee

• Chairman of ACCA Kenya Advisory Committee Members, where he represents ACCA Kenya members at the global International Assembly that helps the Council set strategies to grow ACCA globally

• A former Member of ICPAK’s Financial Services Committee

• Key Microfinance

• Committee Member Public Service Members Club

Luz Maria Salimina

Lead Financial Sector Specialist at World Bank- Session 2:Global Perspectives on Credit Reporting in the face of the COVID 19 pandemic

- Session 6: Q&A arising from Sessions 3, 4 and 5

Luz Maria Salamina is a Lead Financial Sector Specialist for Credit Infrastructure at the World Bank Group, working on Credit Information; Secured Transactions and Collateral Registries; and Insolvency and Debt resolution.

She joined the WBG in April 2014 to work in Sub Saharan Africa promoting reforms on Credit information and support the financial industry resolve challenges and gaps in data related issues. She was the General Manager of the Credit Bureau “APC Buro, S.A.” and Vice President at HSBC and Chase Manhattan Bank in Retail Banking in Panama.

Luz Maria represented ALACRED (the Credit Reporting Association of Latin America) at the International Consumer Credit (ICCR) task force led by the World Bank from 2009 to 2013.

Gerald Nyaoma

Director Bank Supervision of Central Bank of Kenya- Session 3:Regulator’s perspectives on impact of COVID -19 on the CIS mechanism and credit risk management

- Session 6: Q&A arising from Sessions 3, 4 and 5

Mr Gerald Arita Nyaoma, Director, Bank Supervision Department (BSD), joined the Bank in August 1988. He holds an M. Phil. (Econ.) degree from the University of Cambridge, UK, and BA (Economics) from the University of Nairobi. Mr Nyaoma is a Certified Public Accountant (CPAK), a Certified Public Secretary (CPSK) and an Associate of the Kenya Institute of Bankers (AKIB). He previously worked in various departments at the Bank including, Financial Markets, Banking Services, Internal Audit, amongst others. He serves on the Board of the SACCO Societies Regulatory Authority as an Alternate Member to the Governor.

Dr. Habil Olaka

Chief Executive Officer at Kenya Bankers AssociationDr. Olaka was appointed as Chief Executive Officer of the Kenya Bankers Association (KBA) in October 2010. He is responsible for the strategic direction of the Association, covering industry advocacy, development and sustainability. Previously he was the Director of Operations of the East African Development Bank (EADB) based in Kampala after serving as the Resident Manager in Kenya. He earlier served the bank as the Head of Risk Management and as the Chief Internal Auditor.

Before joining the Bank, he had been with Banque Indosuez (now Bank of Africa) as the Internal Auditor. He started his career at the PricewaterhouseCoopers, Nairobi in the Audit and Business Advisory Services Division. He sits on a number of boards representing the KBA. These are Kenya School of Monetary Studies, Kenya Deposit Insurance Corporation, Higher Education Loans Board, National Research Fund, Federation of Kenya Employers, and the Anti-Money Laundering Advisory Board (as alternate to KBA Chairman). He chairs the Public Finance Sector Board of the Kenya Private Sector Alliance (KEPSA). He also sits on the board of Centre for Corporate Governance.

He holds a Doctor of Business Administration from USIU-Africa, a First-Class Honours BSc degree in Electrical Engineering from the University of Nairobi, and an MBA in Finance from the Manchester Business School in the UK. His DBA dissertation was on the influence of strategic leadership on the implementation of strategy in the commercial banks in Kenya.

He is a member of the Institute of the Certified Public Accountants of Kenya (ICPAK). He is an alumnus of the Strathmore School of Accountancy and has a good command of the French language

Dr. Patrick Gathondu

Chief Executive Officer at BIMAS Kenya Limited- Session 5: Industry perspectives on impact of COVID -19 on the CIS mechanism and credit risk management

- Session 6: Q&A arising from Sessions 3, 4 and 5

Dr. Patrick Gathondu is a professional who firmly believes in the ability of microfinance to contribute to development and alleviate poverty. He has worked in the microfinance sector from the year 2003, building an illustrious career from a loans officer to the current position of Chief Executive Officer. Has held various responsibilities in microfinance including; Credit officer, Accountant, Branch Manager, Internal Audit Manager and is currently the Chief Executive Officer of BIMAS Kenya Limited , the Secretary to BIMAS Board of Directors and has just completed a three year term of service as a board member at the Association of Microfinance Institutions of Kenya (AMFIK). He holds a Bachelor of Arts (Economics & Sociology) degree from the University of Nairobi, an MBA in Strategic Management from Kenya Methodist University and a Doctorate degree in Business Administration (Leadership and Change Management) at The United States International University Africa ( USIU-A). Patrick is a professional accountant (CPA (K)) and a full member of the Kenya Institute of Management.

Chief Executive Officer

Jared Getenga

Chief Executive Officer at CIS Kenya- Opening Remarks and Key Note Address

- Session 6: Q&A arising from Sessions 3, 4 and 5

- Session7: Way Forward and Closure

Jared Getenga is the Chief Executive Officer, Credit Information Sharing Association of Kenya (CIS Kenya). He worked for the Central Bank of Kenya (CBK) for more than 20 years in Banking Supervision and Deposit Protection. His Banking Supervision experience was largely in policy formulation on banking sector stability.

He also worked as CBK-Appointed Statutory Advisor, Statutory Manager and Liquidation Agent in several troubled banks. Jared was later appointed Financial Sector Specialist with the Financial and Legal Sector Technical Assistance Project (FLSTAP), funded by the World Bank IDA, DFID and GOK for purposes of coordinating technical assistance to Kenya’s Financial and Legal sectors.

On secondment from CBK, he founded the Kenya Credit Information Sharing Initiative in 2019, as a vehicle to establish the credit information sharing (CIS) mechanism in Kenya. Having registered a nationwide credit providers Association (AKCP) in 2014, he was appointed founder CEO and helped develop mechanisms for self-regulation, alternative dispute resolution, credit scoring, credit risk management etc. He is a committee member of the Africa Credit Information Sharing Association (ACISA) and the International Committee for Credit Reporting (ICCR).

AKCP rebranded to CIS Kenya in order to align more closely to its mandate.

Francis Gwer

Financial Sector Policy Specialist at FSD KenyaFrancis works as a financial sector policy specialist at Financial Sector Deepening Trust (FSD) Kenya. FSD was established in 2005 to support the development of an inclusive financial services sector in Kenya.

Francis manages FSD’s policy work, working with and through policymakers, regulators, and other partners to strengthen the financial sector regulatory system in Kenya.

Kamau Kunyiha

Regional Manager East and Southern Africa at Creditinfo Group- Session 5: Industry perspectives on impact of COVID -19 on the CIS mechanism and credit risk management

- Session 6: Q&A arising from Sessions 3, 4 and 5

Kamau is currently the Regional Manager of East and Southern Africa at Creditinfo Group. He has over 15 years of experience in Credit Information and Information Management Services at the Senior Management Level. Previously the Chief Executive Officer of CRB Africa, (now known as TransUnion). He has worked on the establishment of Credit Bureau operations in 5 countries in Africa, namely Kenya, Rwanda, Zambia, Malawi, and Botswana during his tenure at TransUnion Kenya - formally CRB Africa.

Bartol Letica

Senior Operations officer at International Finance CorporationBartol is a Senior Operations Officer in the International Finance Corporation (IFC)’s Advisory Services team for Sub-Saharan Africa and Middle East/North Africa within Financial Institutions Group, leading a number of credit infrastructure projects in the region including in Kenya, Zambia, Ethiopia, Malawi and Somalia. He is also the focal point for fragile and conflict-affected countries. Bartol previously held a number of positions within IFC and World Bank Group, working for the Public Private Partnership and Investment Climate Departments as well as the Special Assistant for the Vice-President for Advisory Services. He holds B.A. from Yale University (international relations), M.A. from the Fletcher School of Law and Diplomacy (international business), and Ph.D. from the Law School, University of Zagreb (corporate social responsibility).

Lemuel Mangla

Head of Policy & Compliance at CIS KenyaLemuel is a professional in the finance and credit ector with over ten years of hands-on experience. He is adept at leveraging data, technology, financial and interpersonal skills to provide demand-led solutions. Equally, He has a good understanding of credit markets having worked for a Unaitas SACCO society Ltd as a Credit Risk & Recovery Officer. He was instrumental in the development and implementation of digital credit products at Unaitas. He has also been a valuable team player in initiatives such as the transition of the Kenyan market to daily credit reporting under the Kenya Credit Information Sharing Strengthening project.

In addition, He conceptualized and implemented the CIS Learning Centre, an online learning portal that seeks to build the capacity of credit providers on credit information sharing and related areas such as data and technology.

Job Mariga

Head of Technical services at CIS KenyaJob is an IT specialist in the credit reporting environment. Working closely with financial institutions to facilitate the generation, transmission, and use of credit information to the credit bureaus who collate the information and make it meaningful for us in credit risk management. As an enthusiast in Technology and credit risk management practices, he leads discussions that assist lenders in coming up with industry solutions to reduce risks associated with extending credit. Job is currently the Head of Projects & Technical Services at CIS Kenya.

Job holds a Bachelor of Science -IT Degree from Jomo Kenyatta University of Agriculture and Technology

and currently pursuing an MSc in IT Management at the University of Nairobi.

Specialty: Data Analyst

Sam Omukoko

GMD and CEO of Metropol Corporation- Session 5: Industry perspectives on impact of COVID -19 on the CIS mechanism and credit risk management

- Session 6: Q&A arising from Sessions 3, 4 and 5

Sam Omukoko is the Group Managing Director and CEO of Metropol Corporation whose subsidiaries include Metropol Credit Reference Bureau (Kenya and Uganda), Metropol Collection Management Services, Comprehensive Business Media (Metropol TV) and Metropol Institute of Credit Management.

He has been involved in many interventions in financial services and capital markets; credit training; development of credit curricular and credit reporting in a wide range of sectors. He is an Associate of the Chartered Institute of Bankers (ACIB) - UK and a Fellow of the Kenya Institute of Bankers (KIB). He serves as the current Chairman, Banking and Finance Committee at KNCCI.

Sam holds a BSc Math and Statistics and MSc Finance both from the University of Nairobi and CPA (2) Accounting certificate.

Billy Owino

Chief Executive Officer at TransUnion Kenya- Session 5: Industry perspectives on impact of COVID -19 on the CIS mechanism and credit risk management

- Session 6: Q&A arising from Sessions 3, 4 and 5

Billy Owino is a performance driven sales and business development professional with extensive experience in the telecommunications industry working across several countries in Africa and Central Asia. He is a skilled strategic partnerships builder with ecosystem stakeholders. His extensive network of high level contacts within the telecom industry in Africa and internationally spanning MNOs, regulators, device manufacturers (OEMs/ODMs) and the tech community carve him out to be a strong consultative and strategic account manager.